UK TAX GUIDE

This Guide outlines the Value Added Tax (VAT) treatment of Lots sold in Maak's UK based auctions. It covers the most common types of transactions, although other situations may arise. We are not tax specialists and offer this information solely as a courtesy. As every buyer’s situation is different, we cannot offer specific tax advice. You are advised to and are responsible for obtaining independent tax advice where necessary.

The VAT rates and conditions are correct at the time of publication but can change. If the VAT rates and conditions change between the date of publication and the auction date, the rates and conditions in force at the time of auction will apply. Where Lots move from one tax status to another following purchase, the rates and conditions in force at the time of that movement will apply.

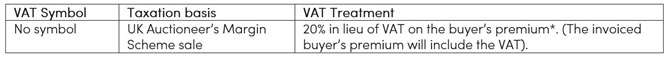

TYPES OF LOTS AND THEIR VAT TREATMENT

UK Auctioneer’s Margin Scheme Lots

Second-hand goods qualifying for treatment under UK Auctioneer’s Margin Scheme rules have no VAT symbol and are treated as follows:

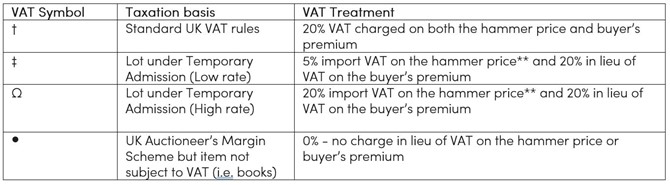

Lots with Special VAT Treatment

If the Lot has one of the below symbols, the VAT treatment will be as follows:

** UK VAT registered buyers - Please give the Maak Accounts department your VAT details so the import paperwork correctly identifies your business as the importer. The Import VAT shown on the invoice is insufficient evidence of import VAT paid.

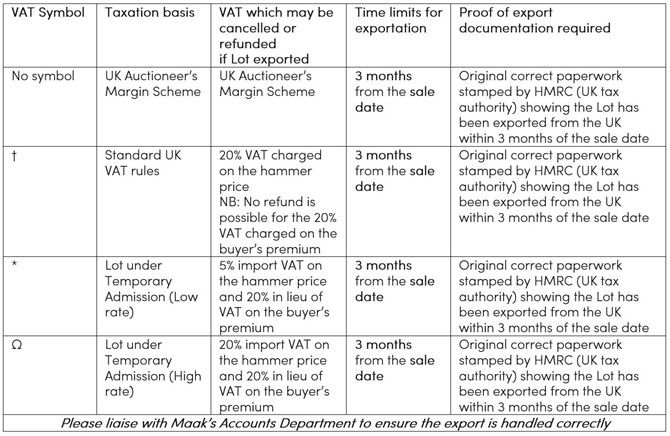

EXPORTING LOTS FROM THE UK

The following types of VAT may be cancelled or refunded by Maak if the Lot is exported from the UK within the time limits specified below provided other strict conditions are met (see Conditions for Claiming VAT Refunds below).

Since 1 January 2021, exports from the UK includes exports to businesses and individuals in the European Union.

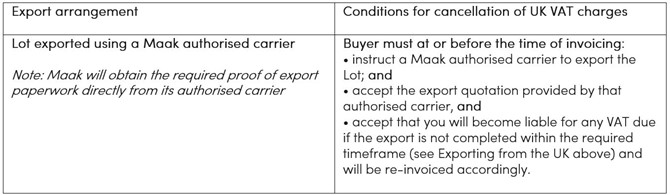

Cancelling UK VAT charges upon export

Provided a buyer instructs a Maak authorised carrier to export the Lot and accepts the export quotation provided by that authorised carrier, Maak can issue a “Zero-rated” invoice (i.e. without the UK VAT).

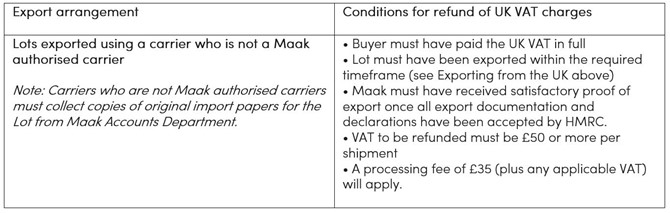

Refunding UK VAT charges following export

If a buyer instructs a carrier who is not a Maak authorised carrier, the buyer must pay for the Lot in full, including the UK VAT. Upon receiving satisfactory proof of export (i.e. copies of the required export documentation and declarations accepted by HMRC) Maak can refund the buyer the UK VAT paid.

Please Note:

- We cannot refund the UK VAT paid if the export documents do not comply exactly with governmental regulations.

- If the Lot is under Temporary Admission in the UK (i.e. with * or Ω, symbol) and is imported to the UK after purchase (i.e. collected by the Buyer in the UK), before then being exported, we cannot refund the UK VAT.

Local tax charges and duties in the Delivery Destination

Buyers from outside the UK should note that upon importing Lots to their final destination outside the UK, local import VAT, import duties, sales taxes and/or use taxes may be payable. Please consult your local tax advisor.

Lots under Temporary Admission being exported for repair, restoration or alteration

If you purchase a Lot which is under Temporary Admission (indicated by a * or a Ω symbol) and intend to export it from the UK for repair, restoration or alteration, please notify the Maak Accounts Department before collection. The Lot will need to be transferred from Temporary Admission to another appropriate customs procedure to allow the repair, restoration or alteration to be carried out. The third-party carrier you appoint to handle the transport will need to liaise with Maak to ensure this customs movement is correctly declared. Failure to do this may result in the UK import VAT becoming payable immediately and Maak being unable to refund the UK VAT charged. You are advised to obtain independent advice on this prior to bidding.

Buyers wishing to hand-carry Lots

If you collect the Lot from Maak in the UK with a view to “hand-carrying” it back to its final destination, you must pay the UK VAT in full. Maak cannot cancel or refund the UK tax in these circumstances. Please note that with the abolition of the Tax-free shopping scheme for visitors to the UK, it is no longer possible to obtain tax refunds at UK airports upon departure.

Business buyers located outside the UK

If you are a business located outside the UK and buy a Lot in a UK sale for a business purpose, you may be able to seek repayment of certain taxes from HMRC (the UK tax authority) directly (e.g. the UK Import VAT charged on the hammer price if the purchased Lot is under Temporary Admission in the UK).

Claim forms (VAT65A) are available from the HMRC website.https://www.gov.uk. You should submit claims for refund of UK VAT to HMRC no later than six months from the end of the 12-month period ending 30 June (e.g., claims for the period 1 July 2020 to 30 June 2021 should be made no later than 31 December 2021)

UK BUYERS

Maak cannot cancel or refund any UK VAT charged on sales made to UK buyers where the Lot is collected from Maak or delivered to a UK address.

For Lots sold under the UK Auctioneer’s Margin Scheme (which do not bear a symbol), UK buyers who have a UK VAT registration may request us to reinvoice the purchase of these Lots under standard UK VAT rules. In this way the UK VAT registered buyer can reclaim all UK VAT charged as part of their accounting for VAT. Please note that UK VAT registered businesses or organisations who request to be reinvoiced under standard UK VAT rules, will then not be able to sell the Lot under any UK Margin Scheme rules in the future.

Sales and Use Taxes

Buyers from outside the UK should note that local sales taxes or use taxes may become payable upon import of lots following purchase. Buyers should consult their own tax advisors.